Information about the CARES Act

CARES Act (HEERF I), CRRSAA Act (HEERF II) and American Rescue Plan Funding (HEERF III)

Reporting for Quarter Ending December 31, 2022

Official Report: 00369400_HEERF_Q42022_010923

CARES Act (HEERF I), CRRSAA Act (HEERF II) and American Rescue Plan Funding (HEERF III)

Reporting for Quarter Ending September 30, 2022

Official report: 00369400_HEERF_Q32022_100322

CARES Act (HEERF I), CRRSAA Act (HEERF II) and American Rescue Plan Funding (HEERF III)

Reporting for Quarter Ending June 30, 2022

Official report: 00369400_HEERF_Q22022_071122

Updated May 2, 2022

CARES Act (HEERF I), CRRSAA Act (HEERF II) and American Rescue Plan Funding (HEERF III)

Reporting for Quarter Ending March 31, 2022

Saint Michael’s College signed and returned a Certification and Agreement with the Department of Education to accept allocated funds under the Coronavirus Aid, Relief and Economic Security Act (CARES Act), the Coronavirus Response and Relief Supplemental Appropriations Act, 2021 (CRRSAA) and the American Rescue Plan of 2021 (ARP) representing (HEERF I, HEERF II, HEERF III) affirming that no less than 50% of the funds would be used to provide Emergency Financial Aid Grants to Students.

The total amount of funds received from HEERF I, II & III respectively.

- $593,400

- $593,400

- $1,609,531.

The total cumulative amount is $2,796,331.

The total amount of HEERF grants distributed to students for quarter ending March 31, 2022 from all sources is $121,000.

The estimated total number of students at the College eligible for HEERF grants for the quarter ending March 31, 2022 was 64.

The total number of students who have received a HEERF Grant for the quarter ending March 31, 2022 is 62.

HEERF III Awarding Methodology-Emergency Grants to Students

Approximately $1.6 million in available funding for students with exceptional financial need. Strategically award grants of up to $3,000 to undergraduate students who meet the criteria below. Students who may be outside of this range as well as international, undocumented and graduate students will be considered upon appeal.

Undergraduate Dependent/Independent Domestic Students

- Exceptional need defined as EFC of $25,000 or less with larger grants awarded to lower EFC

- Awards as follows:

- $3,000 to approx. 268 Pell eligible students (EFC of zero-5,846)

- $2,000 to 189 students with EFC of 5,847-15,000

- $1,000 to 147 students with EFC of 15,001-25,000

- Continue to monitor eligibility as new FAFSAs are received

- February sweep of eligible students based on later FAFSAs (updated 03.15.22)

International Students

- By appeal where student/family documents change in financial circumstances

Appeals

- The remaining amount of funds after block grants were awarded will be available for appeals, graduate student population, DACA and late FAFSA filers.

- Grant amounts up to $3,000 or higher based on appeal

- Consider students who self-identify as having exceptional financial need due to unanticipated financial challenges resulting from COVID-19 such as loss or reduction in employment or housing/food insecurity

Graduate Students (updated 03.15.22)

- Offer $2,000 grants to graduate students enrolled for 6 or more credits. Those enrolled in fewer than 6 credits may be considered based on appeal.

- Exceptional need defined as EFC <= $12,000.

The receipt of emergency financial aid grants to students is not contingent upon continued or future enrollment, is not contingent on GPA or good standing requirements and will not be used toward a student’s account balance without a student’s affirmative consent. Checks will be sent to the student’s home address unless otherwise directed by student.

No student emergency financial aid grant will be distributed in a manner that discriminates on the basis of race, color, national origin, disability or gender.

Instructions, directions, or guidance provided to students concerning the HEERF grants:

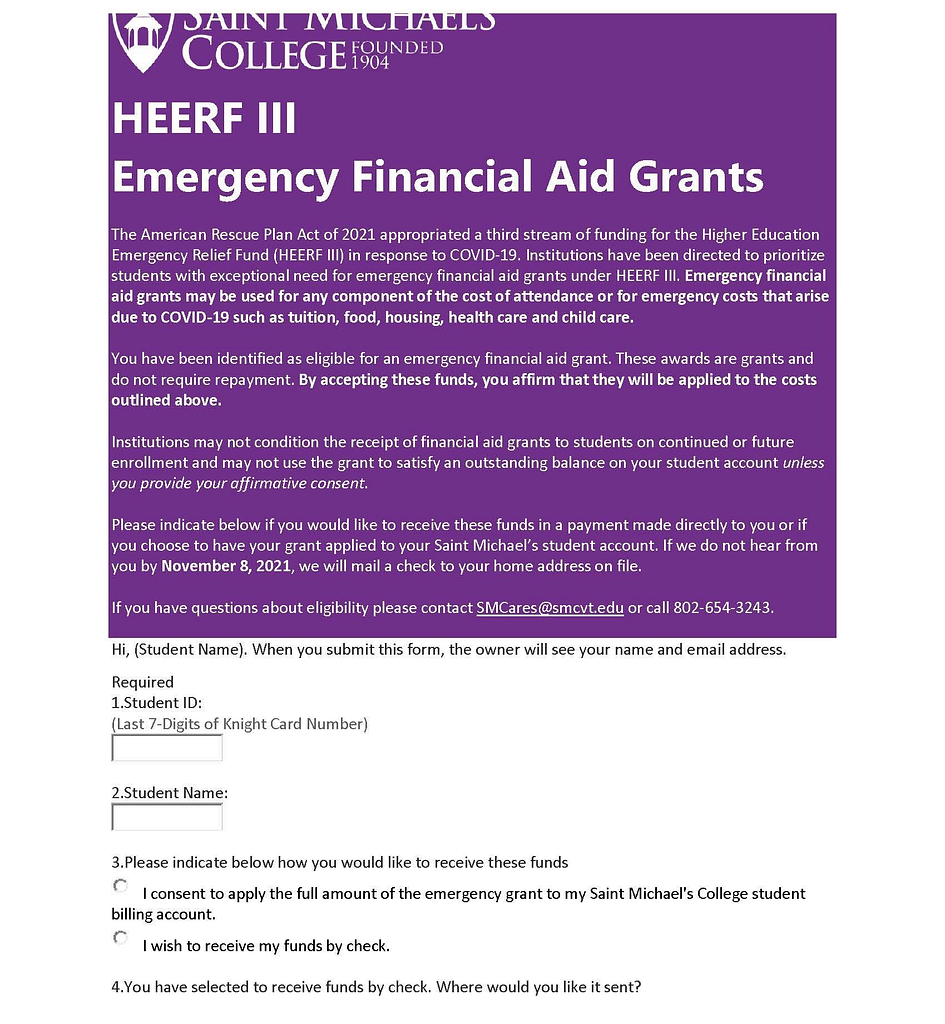

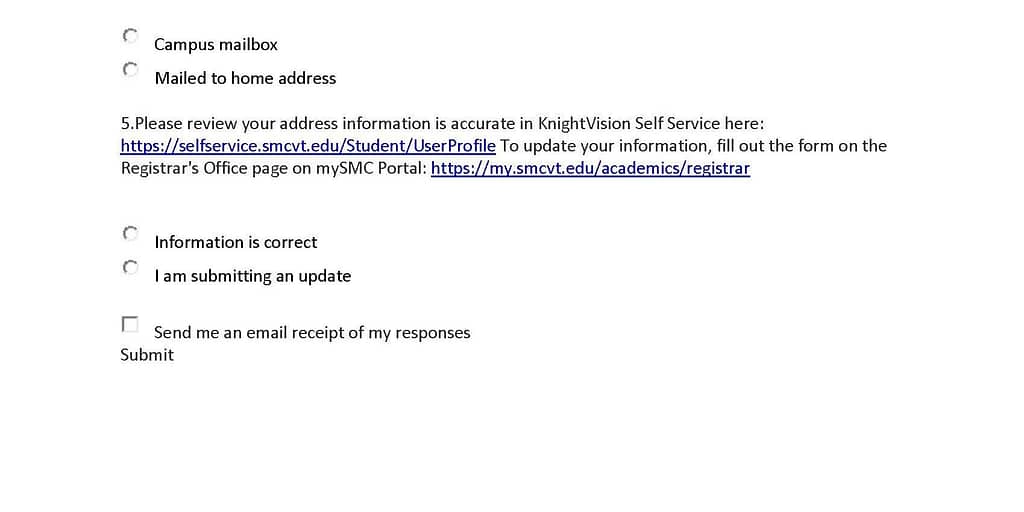

- Dear (Student Name),

The American Rescue Plan Act of 2021 appropriated a third stream of funding through the Higher Education Emergency Relief Fund (HEERF III) to address needs related to the COVID-19 pandemic.

Schools are required to prioritize students with exceptional financial need when delivering HEERF III emergency grants. Emergency financial aid grants may be used for any component of the cost of attendance or for emergency costs due to COVID-19, such as tuition, food, housing, health care, or child care.

We are writing to inform you that you will be receiving an emergency financial aid grant in the amount of $3,000. These awards are grants and do not require repayment. By accepting these funds, you affirm that they will be applied to the allowable costs outlined above.

You may choose to receive a check directly or to have these funds applied to your Saint Michael’s College student account. No part of your student emergency grant funds will be applied to your student account without your authorization. Please indicate here how you would like to receive your funds.

Please respond as soon as possible so that we may complete the processing of your payment. If you do not respond by (X date) we will process your payment via check and mail it to your home address on record.

Your prompt response is appreciated! Thank you,

Student Financial Services

smcares@smcvt.edu

CARES Act (HEERF I), CRRSA Act (HEERF II) and American Rescue Plan Funding (HEERF III)

Reporting for Quarter Ending December 30, 2021

Saint Michael’s College signed and returned a Certification and Agreement with the Department of Education to accept allocated funds under the Coronavirus Aid, Relief and Economic Security Act (CARES Act), affirming that no less than 50% of the funds would be used to provide Emergency Financial Aid Grants to Students.

- Saint Michael’s College received $1,609,531 on 05/20/2021 for student aid under award number P425E200719-20B.

- The total amount of funds received from HEERF I, II & III. 1) $593,400 2) $593,400 3) $1,609,531. The total cumulative amount is $2,796,331.

- The total amount of funds disbursed to students from all HEERF grants for the quarter. $1,335,000

- The estimated number of students eligible for the quarter: 620

- The number of students who received grants during the quarter: 607

- The methodology used to determine funding.

- HEERF III Awarding Strategy-Emergency Grants to Students

- $1.6 million in available funding for students with exceptional financial need. Strategically award grants of up to $3,000 to undergraduate students who meet the criteria below. Students who may be outside of this range as well as international, undocumented and graduate students will be considered upon appeal.

- Undergraduate Dependent/Independent Domestic Students

- Exceptional need defined as EFC of $25,000 or less with larger grants awarded to lower EFC bands.

- Awards as follows:

- $3,000 to approx. 268 Pell eligible students (EFC of zero-5,846)

- $2,000 to approx. 189 students with EFC of 5,847-15,000

- $1,000 to approx. 147 students with EFC of 15,001-25,000

- The total estimated cost based on the current data base is $1,329,000.

- International Students

- By appeal where student/family documents change in financial circumstances

- Appeals

- The remaining amount of approximately $271,000 will be available for appeals, graduate student population, DACA and late FAFSA filers.

- Award amounts up to $3,000.

- Consider students who self-identify as having exceptional financial need due to unanticipated financial challenges resulting from COVID-19 such as loss or reduction in employment or housing/food insecurity.

- The receipt of emergency financial aid grants to students is not contingent upon continued or future enrollment, is not contingent on GPA or good standing requirements and will not be used toward a student’s account balance without a student’s affirmative consent. Checks will be sent to the student’s home address unless otherwise directed by student.

No student emergency financial aid grant will be distributed in a manner that discriminates on the basis of race, color, national origin, disability or gender.

- HEERF III Awarding Strategy-Emergency Grants to Students

- All guidance provided to students concerning HEERF emergency grants is provided below.

- Dear (Student Name),

The American Rescue Plan Act of 2021 appropriated a third stream of funding through the Higher Education Emergency Relief Fund (HEERF III) to address needs related to the COVID-19 pandemic.

Schools are required to prioritize students with exceptional financial need when delivering HEERF III emergency grants. Emergency financial aid grants may be used for any component of the cost of attendance or for emergency costs due to COVID-19, such as tuition, food, housing, health care, or child care.

We are writing to inform you that you will be receiving an emergency financial aid grant in the amount of $3,000. These awards are grants and do not require repayment. By accepting these funds, you affirm that they will be applied to the allowable costs outlined above.

You may choose to receive a check directly or to have these funds applied to your Saint Michael’s College student account. No part of your student emergency grant funds will be applied to your student account without your authorization. Please indicate here how you would like to receive your funds.

Please respond as soon as possible so that we may complete the processing of your payment. If you do not respond by November 8, 2021 we will process your payment via check and mail it to your home address on record.

Your prompt response is appreciated! Thank you,

Student Financial Services

smcares@smcvt.edu

CARES Act (HEERF I), CRRSA Act (HEERF II) and American Rescue Plan Funding (HEERF III)

Report on Student Aid

Reporting Period: September 30, 2021

Saint Michael’s College signed and returned a Certification and Agreement with the Department of Education to accept allocated funds under the Coronavirus Aid, Relief and Economic Security Act (CARES Act), affirming that no less than 50% of the funds would be used to provide Emergency Financial Aid Grants to Students.

(1) Saint Michael’s College received $1,609,531 on 05/20/2021 for student aid under award number P425E200719-20B.

(2) The previous cumulative amount was $1,186,800 for a total cumulative amount of $2,796,331.00.

(3) Saint Michael’s College awarded all funding from HEERF I and HEERF II awards by June 30, 2021. Awards totaled $1,186,800. The unduplicated count of students receiving HEERF I and HEERF II aid was 1,185. For ARP funding, one student received $3,000 award with a remaining total of $1,606,531to be awarded to eligible students.

(4) The total number of students eligible and awarded is yet to be determined as of September 30, 2021.

The estimated number of students at Saint Michael’s College who may be eligible to receive HEERF III grants is approximately 600.

(5) The total number of students who have received an Emergency Financial Aid Grant to students under the CRRSAA and ARP (a)(1) and (a)(4) programs.

409 students received support from CRRSAA and ARP(a)(1)

(6) The method(s) used by the institution to determine which students receive Emergency Financial Aid Grants and how much they would receive under the CRRSAA and ARP (a)(1) and (a)(4) programs.

At the time of this reporting, a comprehensive plan for awarding HEERF III Emergency Grants to students with exceptional need is under development. Grants will also be offered to students who appeal for assistance due to circumstances that were impacted by COVID-19. The one grant disbursed this quarter was based on appeal.

(7) Any instructions, directions, or guidance provided by the institution to students concerning the Emergency Financial Aid Grants.

The following email was sent to all eligible students as identified by student financial services for the HEERF II/CRRSAA funding. Email was sent to their Saint Michael’s College student email address.

Dear «FIRST__NAME»:

This message is to inform you that you are eligible to receive and have been awarded a grant in the amount of $1500

These funds were provided to the College through the CARES Act: Higher Education Relief Fund (HEERF). The funds are intended to offset expenses you have incurred due to the COVID-19 pandemic.

The College has determined your eligibility based on the results of your Free Application for Federal Student Aid (FAFSA). For more information, please review our CARES Act Q&A.

These funds are to provide relief from expenses related to COVID-19 and/or to assist with family finances as a result of hardships created by the COVID-19 pandemic.

You may choose to receive these funds in the form of a payment made directly to you or you may have them applied to your Saint Michael’s College student billing account. Please click on CARES Act HREF II Fund Request Form to select your method of payment.

Please make this selection as soon as possible so that we may complete the processing of your award. If you do not respond by April, 23rd 2021 we will process your award via a check mailed to your address of record.

Your prompt response is appreciated!

Student Financial Services

Finaid@smcvt.edu

Coronavirus Response and Relief Supplemental Appropriations Act (CRRSAA) HEERF II Funding for Student Aid Awards Report as of June 30, 2021

Saint Michael’s College signed and returned a Certification and Agreement with the Department of Education to accept allocated funds under the Coronavirus Aid, Relief and Economic Security Act (CARES Act), affirming that no less than 50% of the funds would be used to provide Emergency Financial Aid Grants to Students.

CRRSAA Federal Award Information

- Saint Michael’s College signed a certificate of agreement and assurances for student aid funding through HEERF II accepting $593,400 on 1/19/2021.

- The college received $593,400 through the HEERF II/CRRSAA funding mechanism provided from the U. S. Department of Education.

CRRSAA Funding Distribution Information

$593,400 was distributed to students by June 30, 2021.

How many students were eligible for awards?

1,606 students were determined to be eligible for the student aid funding through CRRSAA.

How many students received awards?

1,185 students received aid through CRRSAA by June 30, 2021.

When reconciling the HEERF I awards and funds we identified checks that had not been cashed, as reported in our Annual Report to the Department of Education. One final retroactive adjustment/return in the amount of $1375 was posted in the quarter ending June 30, 2021, leaving a net total of $4,000 HEERF I funds that were applied to HEERF II.

How much were students awarded?

- Undergraduate students with EFC less than $9,925 received awards of $1,500.

- Graduate students taking 6 or more credits with EFC LT of $9,925 and not college employees, received $1,500.

- Some students received slightly higher awards based on appeals and circumstances surrounding available funding.

What instructions, directions or guidance was provided by the institution to students concerning the Emergency Financial Aid Grants?

Students were sent an email which provided them a hyperlink with the option to have funds distributed to them by check or to have the funds applied to their Saint Michael’s College tuition billing account. The messaging contained details on what funds were and the purpose of funding.

CARES Act Higher Education Emergency Relief Fund (HEERF)

Student Aid Report

March 30, 2021

Saint Michael’s College signed and returned a Certification and Agreement with the Department of Education to accept allocated funds under the Coronavirus Aid, Relief and Economic Security Act (CARES Act), affirming that no less than 50% of the funds would be used to provide Emergency Financial Aid Grants to Students.

- Saint Michael’s College received $593,400 on 04/13/2020 for student aid under award number P425E200719. Saint Michael’s College received an additional $593,400 under award number P425E200719-20A on 01/19/2021.

- The cumulative amount received is $1,186,800.

- When reconciling the HEERF I awards and funds as of December 31we identified $16,800 in checks that had not been cashed, as reported in our Annual Report to the Department of Education. $4,000 also remained from our original HEERF I award, for a total of $20,800 in unspent funds. We made retroactive 2020 HEERF I grants totaling $5000, and carried the remainder forward to be distributed to Pell-eligible students in our HEERF II award process.

- The total number of students eligible is 1,198.

- The total number of students who have received an Emergency Financial Aid Grant to students under the HEERF I and II is 3. (retroactive 2020 awards)

- The method(s) used by the institution to determine which students receive Emergency Financial Aid Grants:

- Colleges and universities have been encouraged by the federal government to prioritize students with the greatest need. To adhere to that guidance, Saint Michael’s College distributed the funds to eligible students as outlined below:

- Amounts have been based on a student’s Expected Family Contribution (EFC), as reported on the FAFSA.

- EFC Zero to less than 10,000 received $850

- EFC 10,000 to less than 25,000 received $525

- EFC 25,000 to less than 64,000 received $220

- Amounts have been based on a student’s Expected Family Contribution (EFC), as reported on the FAFSA.

- Colleges and universities have been encouraged by the federal government to prioritize students with the greatest need. To adhere to that guidance, Saint Michael’s College distributed the funds to eligible students as outlined below:

- Any instructions, directions, or guidance provided by the institution to students concerning the Emergency Financial Aid Grants. Information was provided through FAQ section on the website under COVID-19 Updates/CARES Act information

- By accepting a disbursement, students attest that they have incurred expenses related to education disruptions caused by the COVID-19 pandemic.

- If you filed a 2019-2020 FAFSA, you do not need to submit a new application. You were considered automatically for the CARES funds. If you did not file a FAFSA, or were notified you would receive funds but have not, please contact SMCares@smcvt.edu.

- If you incurred unexpected expenses due to disruption of campus operations, and did not already receive CARES funds or your expenses exceeded the amount you received, you may be eligible for CARES Act funds. Please contact SMCares@smcvt.edu.

- CARES relief funds are not financial aid and acceptance of other federal, state, or institutional funds is not required in order to receive CARES relief funds. To be eligible to receive the funds, you must have incurred expenses directly related to the disruption of campus operations due to coronavirus. You must also meet all federal student financial aid criteria, as determined through the FAFSA, including the following:

- Be enrolled in a degree or certificate program in the Spring 2020 term, at the time of the campus closing.

- Have Selective Service registration verified.

- Have Social Security Number verified.

- Be making satisfactory academic progress, according to SMC’s policy.

- Not owe an overpayment on federal student aid.

- Not be in default on a federal student loan.

- Be A U.S. citizen or national, permanent resident, or other eligible noncitizen.

- Have returned fraudulently obtained federal student aid if convicted of or pled guilty or no contest to charges.

- Not have fraudulently received federal student loans in excess of annual or aggregate limits.

- Have repaid federal student loan amounts in excess of annual or aggregate limits if obtained inadvertently.

- Not have a federal or state conviction for drug possession or sale.

CARES Act Higher Education Emergency Relief Fund (HEERF)

Student Aid Report

December 31, 2020

Saint Michael’s College signed and returned a Certification and Agreement with the Department of Education to accept allocated funds under the Coronavirus Aid, Relief and Economic Security Act (CARES Act), affirming that no less than 50% of the funds would be used to provide Emergency Financial Aid Grants to Students.

- Saint Michael’s College received $593,400 on 04/13/2020 for student aid under award number P425E200719.

- The cumulative amount received is $593,400.

- $589,400 was distributed to students (cumulative through 12/31/2020). When later reconciling the HEERF I awards and funds as of December 31we identified $16,800 in checks that had not been cashed, as reported in our Annual Report to the Department of Education. These funds were later rolled into HEERF II.

- The total number of students eligible is 1,198.

- The total number of students who have received an Emergency Financial Aid Grant to students under the HEERF I is 1,055.

- The method(s) used by the institution to determine which students receive Emergency Financial Aid Grants:

- Colleges and universities have been encouraged by the federal government to prioritize students with the greatest need. To adhere to that guidance, Saint Michael’s College distributed the funds to eligible students as outlined below:

- Amounts have been based on a student’s Expected Family Contribution (EFC), as reported on the FAFSA.

- EFC Zero to less than 10,000 received $850

- EFC 10,000 to less than 25,000 received $525

- EFC 25,000 to less than 64,000 received $220

- Amounts have been based on a student’s Expected Family Contribution (EFC), as reported on the FAFSA.

- Colleges and universities have been encouraged by the federal government to prioritize students with the greatest need. To adhere to that guidance, Saint Michael’s College distributed the funds to eligible students as outlined below:

- Any instructions, directions, or guidance provided by the institution to students concerning the Emergency Financial Aid Grants. Information was provided through FAQ section on the website under COVID-19 Updates/CARES Act information

- By accepting a disbursement, students attest that they have incurred expenses related to education disruptions caused by the COVID-19 pandemic.

- If you filed a 2019-2020 FAFSA, you do not need to submit a new application. You were considered automatically for the CARES funds. If you did not file a FAFSA, or were notified you would receive funds but have not, please contact SMCares@smcvt.edu.

- If you incurred unexpected expenses due to disruption of campus operations, and did not already receive CARES funds or your expenses exceeded the amount you received, you may be eligible for CARES Act funds. Please contact SMCares@smcvt.edu.

- CARES relief funds are not financial aid and acceptance of other federal, state, or institutional funds is not required in order to receive CARES relief funds. To be eligible to receive the funds, you must have incurred expenses directly related to the disruption of campus operations due to coronavirus. You must also meet all federal student financial aid criteria, as determined through the FAFSA, including the following:

- Be enrolled in a degree or certificate program in the Spring 2020 term, at the time of the campus closing.

- Have Selective Service registration verified.

- Have Social Security Number verified.

- Be making satisfactory academic progress, according to SMC’s policy.

- Not owe an overpayment on federal student aid.

- Not be in default on a federal student loan.

- Be A U.S. citizen or national, permanent resident, or other eligible noncitizen.

- Have returned fraudulently obtained federal student aid if convicted of or pled guilty or no contest to charges.

- Not have fraudulently received federal student loans in excess of annual or aggregate limits.

- Have repaid federal student loan amounts in excess of annual or aggregate limits if obtained inadvertently.

- Not have a federal or state conviction for drug possession or sale.

CARES Act Higher Education Emergency Relief Fund (HEERF)

Student Aid Report

September 30, 2020

Saint Michael’s College signed and returned a Certification and Agreement with the Department of Education to accept allocated funds under the Coronavirus Aid, Relief and Economic Security Act (CARES Act), affirming that no less than 50% of the funds would be used to provide Emergency Financial Aid Grants to Students.

- Saint Michael’s College received $593,400 on 04/13/2020 for student aid under award number P425E200719.

- The cumulative amount received is $593,400.

- $589,400 was distributed to students

- The total number of students eligible is 1,198.

- The total number of students who have received an Emergency Financial Aid Grant to students under the HEERF I is 1,055.

- The method(s) used by the institution to determine which students receive Emergency Financial Aid Grants:

- Colleges and universities have been encouraged by the federal government to prioritize students with the greatest need. To adhere to that guidance, Saint Michael’s College distributed the funds to eligible students as outlined below:

- Amounts have been based on a student’s Expected Family Contribution (EFC), as reported on the FAFSA.

- EFC Zero to less than 10,000 received $850

- EFC 10,000 to less than 25,000 received $525

- EFC 25,000 to less than 64,000 received $220

- Amounts have been based on a student’s Expected Family Contribution (EFC), as reported on the FAFSA.

- Colleges and universities have been encouraged by the federal government to prioritize students with the greatest need. To adhere to that guidance, Saint Michael’s College distributed the funds to eligible students as outlined below:

- Any instructions, directions, or guidance provided by the institution to students concerning the Emergency Financial Aid Grants. Information was provided through FAQ section on the website under COVID-19 Updates/CARES Act information

- By accepting a disbursement, students attest that they have incurred expenses related to education disruptions caused by the COVID-19 pandemic.

- If you filed a 2019-2020 FAFSA, you do not need to submit a new application. You were considered automatically for the CARES funds. If you did not file a FAFSA, or were notified you would receive funds but have not, please contact SMCares@smcvt.edu.

- If you incurred unexpected expenses due to disruption of campus operations, and did not already receive CARES funds or your expenses exceeded the amount you received, you may be eligible for CARES Act funds. Please contact SMCares@smcvt.edu.

- CARES relief funds are not financial aid and acceptance of other federal, state, or institutional funds is not required in order to receive CARES relief funds. To be eligible to receive the funds, you must have incurred expenses directly related to the disruption of campus operations due to coronavirus. You must also meet all federal student financial aid criteria, as determined through the FAFSA, including the following:

- Be enrolled in a degree or certificate program in the Spring 2020 term, at the time of the campus closing.

- Have Selective Service registration verified.

- Have Social Security Number verified.

- Be making satisfactory academic progress, according to SMC’s policy.

- Not owe an overpayment on federal student aid.

- Not be in default on a federal student loan.

- Be A U.S. citizen or national, permanent resident, or other eligible noncitizen.

- Have returned fraudulently obtained federal student aid if convicted of or pled guilty or no contest to charges.

- Not have fraudulently received federal student loans in excess of annual or aggregate limits.

- Have repaid federal student loan amounts in excess of annual or aggregate limits if obtained inadvertently.

- Not have a federal or state conviction for drug possession or sale.

CARES Act Higher Education Emergency Relief Fund (HEERF)

Student Aid Report

June 30, 2020

Saint Michael’s College signed and returned a Certification and Agreement with the Department of Education to accept allocated funds under the Coronavirus Aid, Relief and Economic Security Act (CARES Act), affirming that no less than 50% of the funds would be used to provide Emergency Financial Aid Grants to Students.

- Saint Michael’s College received $593,400 on 04/13/2020 for student aid under award number P425E200719.

- The cumulative amount received is $593,400

- No awards have been made at the time of this report

- The total number of students eligible and awarded is yet to be determined as June 30, 2020.

- The total number of students who have received an Emergency Financial Aid Grant to students under the HEERF I is 0.

- The method(s) used by the institution to determine which students receive Emergency Financial Aid Grants is under development.

- Any instructions, directions, or guidance provided by the institution to students concerning the Emergency Financial Aid Grants. No guidance has been provided as of June 30, 2020.

More information about the CARES Act and the College’s Institutional HEERF award can be found here.

Information about Higher Education Emergency Relief Fund (HEERF) III

The American Rescue Plan Act (ARP) of 2021 appropriated a third stream of funding through the Higher Education Emergency Relief Fund (HEERF III) to address needs related to the COVID-19 pandemic. ARP funding is in addition to funds authorized by the Coronavirus Response and Relief Supplemental Appropriations Act (CRRSAA) and the Coronavirus Aid, Recovery and Economic Security (CARES) Act.

Schools are required to prioritize students with exceptional financial need when delivering HEERF III emergency grants. Block grants to students determined to have exceptional need have been awarded. Additional funds may be awarded based on appeal if the student documents exceptional need resulting from COVID-19.

The receipt of emergency financial aid grants to students is not contingent upon continued or future enrollment, is not contingent on GPA or good standing requirements and will not be used toward a student’s account balance without the student’s affirmative consent.

Emergency financial aid grants may be used for any component of the cost of attendance or for emergency costs due to COVID-19, such as tuition, food, housing, health care, or child care.

The funds provided through HEERF III are grants and do not require repayment.

No. Emergency financial aid grants are not financial aid, are not counted as estimated financial assistance and are not counted as income when determining eligibility for financial aid.

No. An emergency financial aid grants made by an institution of higher education to a student because of an event related to the COVID-19 national emergency is not included in the student’s gross income. For more information, please see the Internal Revenue Service (IRS) bulletin Emergency aid granted to students due to COVID is not taxable (March 30, 2021).

Please send questions to our designated inbox: SMCares@smcvt.edu.

The HEERF III funds are a federal government grant and are distinct from your Saint Michael’s College financial aid. Regardless of your eligibility for the HEERF funds, if you or your family’s financial situation has changed since you filed the FAFSA, please reach out to our Student Financial Services team at FinAid@smcvt.edu.

No student emergency financial aid grant will be distributed in a manner that discriminates on the basis of race, color, national origin, disability or gender.

Information about CARES Act/Higher Education Emergency Relief Fund II

Higher Education Emergency Relief Funds II (HEERF II) created under the Coronavirus Response and Relief Supplemental Appropriations Act (CRRSAA) signed on December 27, 2020.

The Consolidated Appropriations Act, 2021 included additional COVID-19 relief through the Coronavirus Response and Relief Supplemental Appropriations (CRRSA) Act. This new COVID stimulus bill included $23 billion for higher education institutions and students, using the same Higher Education Emergency Relief Fund (HEERF) model established in the Coronavirus Aid, Relief and Economic Security (CARES) Act.

Unlike the CARES Act, the CRRSAA does not require that 50% of an institution’s funds be spent on student grants. It does, however, require that institutions spend at least the same dollar amount on student grants as they were required to spend under the CARES Act. In addition, the allowable uses of funds are more flexible than in the CARES Act

Similar to CARES (HEERF I), the CRRSAA (HEERF II) includes no student eligibility requirements, however, institutions are required to prioritize grants to students with exceptional financial need, such as those who receive Pell Grants. The HEERF II funds can be awarded to online students as well.

Saint Michael’s College will notify eligible students through their SMC Email account with instructions on how to accept their awards.

CARES Act/HEERF II funds are meant to help students meet their primary expenses related to the COVID-19 pandemic. Institutions may award student grants for the following:

- any component of their cost of attendance

- emergency costs that arise due to coronavirus, such as:

- tuition

- food

- housing

- health care (including mental)

- child care

Students will not be required to provide receipts if they choose to use funding for expenses such as food, housing, etc.

The funds provided through CARES Act/HEERF II are grants, not loans, and do not need to be paid back.

No. Money from CARES Act/HEERFII is not considered financial assistance und the federal statute. These funds will not impact your eligibility for regular financial aid (e.g. grants, scholarships, loans).

No. The Internal Revenue Service (IRS) announced that the emergency financial aid grants under the CARES Act are qualified disaster relief payments under section 139 of the Internal Revenue Code. This grant is not includible in your gross income.

Please send CARES Act questions to our designated inbox: SMCares@smcvt.edu.

The CARES Act funds are a federal government grant and are separate from your Saint Michael’s College financial aid. Regardless of your eligibility for the CARES Act, if you are struggling with your upcoming tuition, or an outstanding bill, please reach out to our Student Financial Services team at FinAid@smcvt.edu.

Additional Information on the CARES Act

The federal CARES (Coronavirus Aid, Relief, and Economic Security) Act is intended to help students by providing emergency grants for expenses related to the disruption of campus operations due to coronavirus. The funds are for students – to help with eligible expenses related to the cost of attendance such as food, housing, course materials, technology, health care, and childcare.

Allocation of the federal CARES Act funding to higher education institutions was based on total enrollment and the ratio of Federal Pell Grant recipients to total enrollment. Saint Michael’s College has signed and returned the Certification and Agreement form to receive our federal allocation for students of $593,400.

More information about the CARES Act and the College’s Institutional HEERF award can be found here.

1198 Saint Michael’s College students were deemed potentially eligible to receive these funds according to government guidelines. Eligibility was determined solely based on the results of your 2019-2020 FAFSA and the criteria below. If you filed a FAFSA, no additional application was required. If you did not file a FAFSA, but wish to be considered for CARES funds, you must submit a request to SMCares@smcvt.edu.

CARES relief funds are not financial aid and acceptance of other federal, state, or institutional funds is not required in order to receive CARES relief funds. To be eligible to receive the funds, you must have incurred expenses directly related to the disruption of campus operations due to coronavirus. You must also meet all federal student financial aid criteria, as determined through the FAFSA, including the following:

- Be enrolled in a degree or certificate program in the Spring 2020 term, at the time of the campus closing.

- Have Selective Service registration verified.

- Have Social Security Number verified.

- Be making satisfactory academic progress, according to SMC’s policy.

- Not owe an overpayment on federal student aid.

- Not be in default on a federal student loan.

- Be A U.S. citizen or national, permanent resident, or other eligible noncitizen.

- Have returned fraudulently obtained federal student aid if convicted of or pled guilty or no contest to charges.

- Not have fraudulently received federal student loans in excess of annual or aggregate limits.

- Have repaid federal student loan amounts in excess of annual or aggregate limits if obtained inadvertently.

- Not have a federal or state conviction for drug possession or sale.

Update on the HEERF I funds awarded in March 2020:

All funds from HEERF I were awarded to students. Students were provided support regarding their awards and received their funds via check. Regular communications to students encouraged them to cash their checks or request a new check if they had not received their check or it was misplaced. In reconciling the HEERF I awards and funds on December 31, $15,800 in checks were not cashed. This was reported in our Annual Report to the Department of Education. These funds were rolled over into the HEERF II award process and will be distributed to Pell Eligible students with HEERF II awards.

Colleges and universities have been encouraged by the federal government to prioritize students with the greatest need. To adhere to that guidance, Saint Michael’s College distributed the funds to eligible students as outlined below:

Amounts have been based on a student’s Expected Family Contribution (EFC), as reported on the FAFSA.

- EFC Zero to less than 10,000 received $850

- EFC 10,000 to less than 25,000 received $525

- EFC 25,000 to less than 64,000 received $220

Student Financial Services has the discretion based on appeals and professional judgment to increase individual awards.

If you filed a 2019-2020 FAFSA, you do not need to submit a new application. You were considered automatically for the CARES funds. If you did not file a FAFSA, or were notified you would receive funds but have not, please contact SMCares@smcvt.edu.

As of the quarter ending September 30, 2020 a total of $588,025 was distributed to 1,025 Saint Michael’s students. The remaining funds of $5,375 were disbursed to 3 students in the quarter ending December 31.

The College partnered with Heartland ECSI to facilitate the disbursement of funds.

By accepting a disbursement, students attest that they have incurred expenses related to education disruptions caused by the COVID-19 pandemic.

The CARES Act funds are a federal government grant, intended to help with the immediate impact of disruption of campus operations (e.g.: extra trip to campus, upgrading wifi at home to take online classes, etc.). This money is separate from your Saint Michael’s College financial aid. Regardless of your eligibility for the CARES Act, if you are struggling with your College bill or other educational expenses, please reach out to our Student Financial Services team at FinAid@smcvt.edu.

If you incurred unexpected expenses due to disruption of campus operations, and did not already receive CARES funds or your expenses exceeded the amount you received, you may be eligible for CARES Act funds. Please contact SMCares@smcvt.edu.

Please send CARES Act questions to our designated inbox: SMCares@smcvt.edu.

The CARES Act funds are a federal government grant and are separate from your Saint Michael’s College financial aid. Regardless of your eligibility for the CARES Act, if you are struggling with your upcoming tuition, or an outstanding bill, please reach out to our Student Financial Services team at FinAid@smcvt.edu.